Learn about Fraud Awareness

Learn about fraud awareness at Columbia University.

Details

We perform investigations of reported or discovered fraud as well as provide fraud awareness training to the University to prevent future occurrences. Fraud investigations are conducted in collaboration with Public Safety, Office of General Counsel, or the Compliance Hotline Committee.

What is Fraud?

Fraud is a deliberate misrepresentation that causes a person or business to suffer damages, often in the form of monetary losses through deception or concealment.

The Association of Certified Fraud Examiners (ACFE) defines occupational Fraud as: “The use of one’s occupation for personal enrichment through the deliberate misuse or misapplication of the employing organization’s resources or assets.

Impact of Fraud

- Fewer pay increases

- Increased layoffs

- Greater pressure to increase revenue

- Decreases in employee benefits

- Low employee morale

- Negative publicity for the organization

Types of Fraud

Occupational Fraud and Misappropriation of Assets

- Stealing money or inventory

- Claiming overtime for hours not worked

- Filing fraudulent expense reports

- Giving unauthorized discounts on company merchandise or services

- Adding ghost employees to the payroll

- Skimming cash receipts

- Falsifying voids and refunds

- Tampering with company checks

- Overstating expenses

Corruption and Fraudulent Statements

- Corruption:

- Conflicts of interest

- Illegal gratuities

- Bribery

- Fraudulent statements:

- Creating fictitious revenues

- Concealing liabilities or revenues

How is Fraud Discovered?

Fraud can be discovered by a Tip, Management Review, Internal Audit, by Accident, Account Reconciliation, Document Examination, External Audit, Monitoring, Notification by Police, Confession, and IT Controls.

How to Report Fraud

Report any suspicions to your organization. Available 24 hours a day, 7 days a week, feel free to contact the Compliance Hotline.

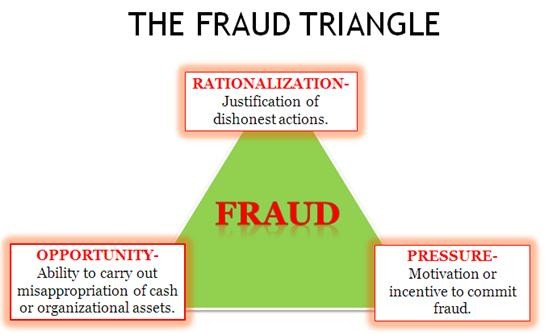

Fraud Contributing Factors & Red Flags

Contributing factors to fraud include:

- Poor internal controls

- Management override of internal controls

- Collusion between employees

- Collusion between employees and third parties

Red flags are warnings that something could be or is wrong. Auditors, employees, and management need to be aware of red flags in order to monitor the situation and then take corrective action as needed.

Employees who notice that red flags are ignored believe that they won’t get caught. A little fraud soon becomes a large one if left to grow.

Compliance Hotline

Visit the Compliance Hotline website to anonymously report or seek guidance on possible compliance issues, via telephone or online.

Office of the General Counsel

You are invited and encouraged to contact the Office of the General Counsel for assistance on matters affecting the University.

Still have questions?

Visit our Service Center.